Am I Financially Prepared to Take Out a Home Loan?

October 19, 2022

October 19, 2022

You feel ready to own your own home, but are you financially ready for a mortgage? If you want to know how close you are to being able to take out a home loan, you’ll want to consider how your credit, debt and recent financial history stack up and what steps you may need to take to improve them.

Homebuyers who are ready to take on a mortgage typically have similar financial profiles. This often means:

Depending on your financial profile, you may be ready, near ready or not currently ready for a mortgage. The below chart offers a quick look at how these factors may affect your ability to qualify for a mortgage.

| Ready (All of the following) | Near Ready (All of the following) | Not Currently Ready (Any of the following) | |

|---|---|---|---|

| Credit Score | 661 or higher | 600-660 | 599 or less |

| DTI ratio | 25% or less | 25% or less | Greater than 25% |

| Foreclosures or bankruptcies in the past 84 months | No | No | Yes |

| Severe delinquencies* in the past 12 months | No | No | Yes |

*Severe delinquency defined as mortgage payments more than 120 days overdue.

If you are not ready for a mortgage today, that’s OK. You can take steps to improve your finances over time.

Your credit score summarizes your credit profile and predicts the likelihood that you'll repay future debts. Credit scores change often, as does the information in your credit history.

If your credit score puts you in the near ready or not currently ready group, here are steps you can take to build your credit history and improve your score. These include:

If you need to build or rebuild credit, be patient. The best practice is to review your credit regularly and manage your credit wisely over time.

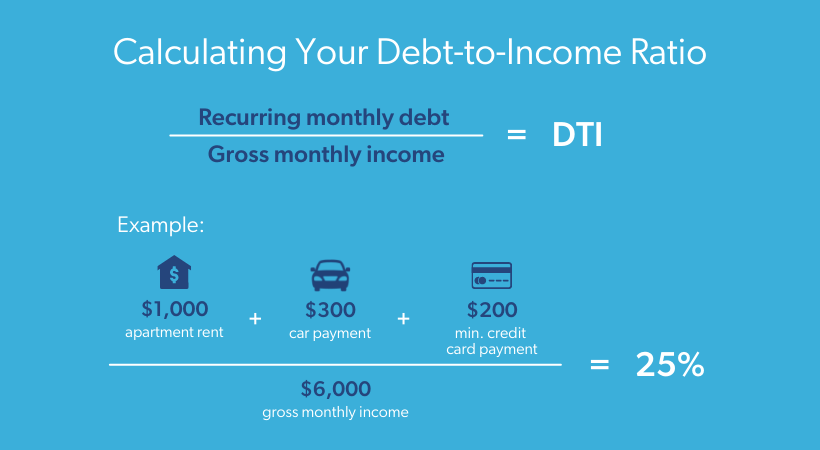

Your DTI ratio shows how much of your monthly income you're using to pay your debt.

To calculate your DTI, divide your total recurring monthly debt (your rent and any auto loan or credit card payments) by your gross monthly income (the total amount you make each month before taxes, withholdings and expenses). The below graphic offers an example for how to calculate your DTI.

If your DTI ratio is keeping you from being ready for a mortgage, you can work toward reducing your debt with the help of education tools and resources, including Freddie Mac's CreditSmart®.

You should also consider working with a housing counseling agency approved by the U.S. Department of Housing and Urban Development (HUD) to learn about financial literacy topics, such as credit restoration, budget management and other principles.

If you've gone through foreclosure or bankruptcy, or you've had trouble paying for your housing, working with a certified housing counselor can help improve your financial picture.

Free phone assistance from HUD-certified housing counselors is available at 877-300-4179, or you can use one of Freddie Mac’s Borrower Help Centers.