One of the most effective ways to build wealth is to invest your money. But how should you do it, how long should it take and when should you start?

Working is a reliable way to earn money and gradually increase your wealth over time. However, there are several ways in which you can invest the money you’ve earned to grow your wealth more quickly, ensuring you are well positioned to meet your financial goals — whether that’s buying a home, starting a business or retiring comfortably.

Before you invest, you should build an emergency fund of at least three to six months of living expenses for unexpected life situations. Once you’re ready to invest, it’s important for you to speak with a financial planner or investment advisor to find the strategy that best meets your goals and your risk tolerance.

Here are common investments and tips you may want to follow.

How Should I Invest?

Investing to build wealth can take many forms. Though you may want to consider a combination of investments — including various funds, accounts and assets — the most effective wealth-building strategies involve two primary actions:

- Paying yourself first: A strategy where you put money into your investment and savings accounts before paying down or adding new debt.

- Automating your savings: A strategy where you automatically set aside a predetermined amount of money on a consistent schedule.

From there, you may want to consider investing your money in the following ways:

- Participating in a retirement savings program: 401(k), 403(b), employer matches, individual retirement account (IRA), Roth IRA and thrifts.

- Owning high-yield savings accounts: Certificates of deposit (CDs), stocks, mutual funds, annuities and individual development accounts.

- Owning real estate: Investing in real estate builds wealth through equity. Receiving down payment assistance can help you into your first home.

Given all these options, investing can seem intimidating. Luckily there are experts ready to help you make the best decision for your situation, including:

- Certified financial planners (CFPs).

- Chartered financial analysts (CFAs).

- Financial advisors and brokers. You can research financial advisors, brokers and other firms with BrokerCheck® by FINRA, a free, online tool.

- Financial coaches and the AFCPE®: A non-profit, financial counseling organization with a mission of empowering all people with resources designed for lasting financial well-being.

The National Association of Personal Financial Advisors and the Financial Planning Association can help you locate a financial planner in your local area.

How Long Will It Take to Build Wealth?

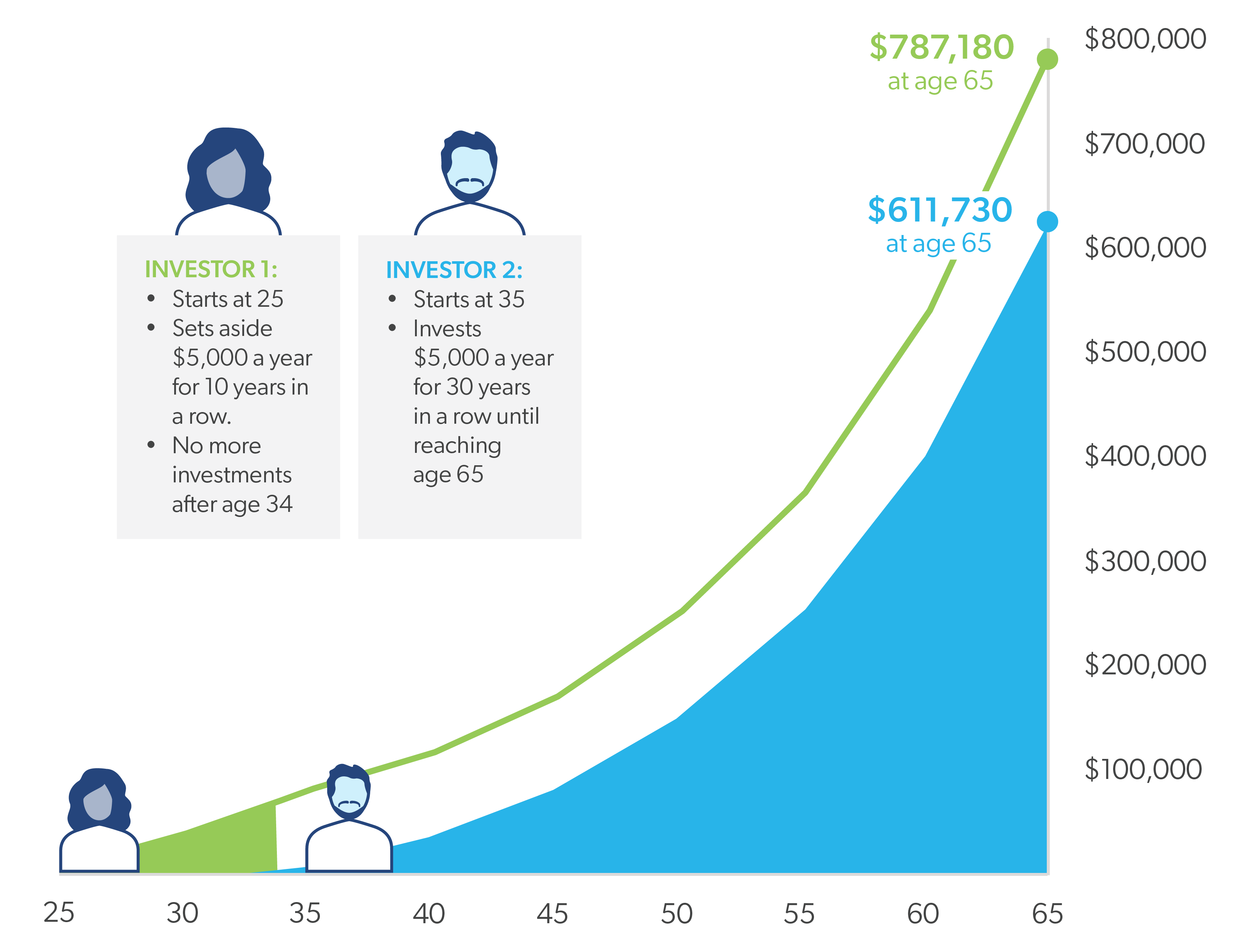

The best way to reach your savings goal is to consistently save money and use the power of compound interest to build wealth more quickly. Compound interest is the interest you earn on interest (see chart below).

Once you have an idea of how much money you'd like to save, you can use the Rule of 72 to better calculate when you’ll reach your savings goal. The simple calculation shows you how many years it will take to double your investment given your interest rate.

The lower your interest rate is, the longer it will take for an investment to double.

When Should I Start Investing?

To build wealth, you should begin investing as early as you can and stay in the market. But it’s never too late to start.

Consider the following example: A 25-year-old and a 35-year-old each want to retire at 65 and find an investment with an 8% interest rate. The 25-year-old invests $5,000 each year for 10 consecutive years and then makes no additional investments. The 35-year-old invests $5,000 each year for 30 consecutive years. Thanks to the power of compound interest, the 25-year-old was able to save $170,000 more than the 35-year-old by starting early.

Remember, you can make money by investing, but you can also lose money. It’s important to conduct your own research and speak with professionals to invest wisely and in a way that works best for your financial situation.

Last reviewed: January 21, 2026

My Home in your inbox

Sign up to receive resources, tools and tips about buying, owning, refinancing, selling and renting a home in your inbox.